Pioneering Real-World Asset Innovation Since 2006

RarityX provides patented systems that enable fractional and tokenized ownership, and exchange operations across tangible, intangible, physical, digital, and phygital assets.

RarityX:

Built to Fractionalize and Trade Real-World Value

RarityX is a pioneering technology and intellectual property company focused on computer-implemented systems for fractional ownership, tokenization, governance, liquidity provision, and market operations across diverse asset categories and investment units. In various embodiments, RarityX solutions may be configured to support tangible, intangible, physical, and digital assets, including real estate, commodities, collectibles, debt instruments, equity interests, hybrid asset formats, and related governance structures. RarityX holds a family of core patents, trademarks, and other intellectual property directed to, but not limited to, computer-implemented architectures that enable controlled issuance, fractional ownership integrity, governance controls, provenance verification, legacy protection, digital convergence, and transaction execution for traditionally illiquid Real-World Assets (RWA) in fractionalized and tokenized (real-world value across primary and secondary markets).

Patented Capabilities

RarityX patents cover end-to-end capabilities for asset lifecycle, fractionalization (traditional and DeFi P2P), custody, exchange rules, data provenance, verification, audit trails, and representation across debt (e.g., corporate bonds, municipal bonds, etc.), real estate (commercial, industrial, rental properties, etc.), equity (private and public, etc.), commodities (etc.), all collectibles and rarities (e.g., art, wine, watches, classic cars, etc.), physical and intangible assets, fiat-backed units, and any IP-derived investment unit.

End-to-End Asset Trading

RarityX is a patented exchange that supports end-to-end asset fractionalization and primary and secondary trading across debt (e.g., corporate bonds, municipal bonds, etc.), real estate (commercial, industrial, rental properties, etc.), equity (private and public, etc.), commodities (etc.), all collectibles and rarities (e.g., art, wine, watches, classic cars, etc.), physical and intangible assets, fiat-backed units, and any IP-derived investment unit.

All Exchange Infrastructure for Partners

RarityX is a patented exchange infrastructure that third parties use to create and operate markets for real-world value, using one or more IP-licensed exchange partnerships, investment banks, and supporting market infrastructure.

Governance, Fractionalization & Transfer

RarityX enables governance, fractionalization, transfer, and trading of real-world value through exchange-level rules that can be applied consistently across different asset classes and market arrangements.

Primary & Secondary Market Support

RarityX supports both primary issuance and secondary market activity, whether markets are operated directly by partners or integrated through licensed exchanges and financial-institution relationships.

Configurable Rules

RarityX applies configurable rules at the exchange layer, allowing markets to enforce participation, lifecycle, and governance conditions across partner-operated and infrastructure-integrated environments.

Market Flexibility

RarityX operates across centralized, decentralized, and hybrid market structures, supporting multiple operating models rather than a single exchange format.

Verification & Trust Services

RarityX supports verification, provenance, and trust services as optional components, which may be provided internally or through licensed partners and infrastructure providers.

Future-Proof Architecture

RarityX is built to adapt as markets evolve, enabling new asset classes, partnerships, and infrastructure integrations over time.

HISTORY of LIQUID RARITY EXCHANGE -RarityX

Liquid Rarity Exchange, today dba RarityX’s foundational IP and technology—pioneered as early as 2006—powers the core systems used across today’s Real-World Asset ecosystems, with patented architectures for fractional ownership and trading of traditional securities and peer-to-peer cryptographic assets across primary issuance and secondary markets, delivering configurable toolkits and infrastructure for Real-World Asset exchanges and platforms.

Prior to RarityX, peer-to-peer activity on public blockchains was dominated by native cryptocurrencies that were not backed by authenticated physical, tangible, intangible, or otherwise documented real-world assets. RarityX facilitates blockchain-based records associated with authenticated RWA assets.

CIRCA August 2012

TRIBUTE TO ANDY SAIGH (1983–2024). HIS INSPIRATION, AS REFLECTED IN HIS 2012 INTERVIEW ON FOX BUSINESS NEWS, WAS TO HELP SMALL INVESTORS BY EXPANDING ACCESS, FAIRNESS, AND OPPORTUNITY THROUGH TRANSPARENCY AND EFFICIENCY IN WHAT IS NOW REFERRED TO AS REAL-WORLD ASSETS.

Liquid Rarity Exchange (“LRE”) dba RarityX was originally conceived to create a trusted, technology-driven trading exchange that gives small investors equal opportunity alongside institutional investors by delivering transparency, market trading efficiency, and verifiable trust at the infrastructure level. LRE achieves this by operating as an asset-agnostic platform for representing and exchanging ownership and associated rights in any asset or asset interest through authoritative, digitally recorded representations that may be tokenized or non-tokenized and may be denominated, settled, or exchanged in any investment unit, including fiat currency units, tokenized units (including stablecoins and cryptoassets), credit units, or hybrid consideration. These representations can be exchanged peer-to-peer or through multi-party workflows under cryptographically authorized governance, enabling market participants to transact with reduced counterparty risk and fewer costly intermediaries. LRE preserves chain-of-title continuity and creates a more efficient and transparent marketplace in which pricing, provenance, and settlement integrity are accessible to all participants, thereby leveling the playing field between retail and institutional investors while supporting scalable, compliant, and commercially practical trading of real-world assets at global scale.

REAL-WORLD ASSETS

ASSET CLASSES

RarityX’s patent toolkit architecture is designed to support all types of investment unit structures used to express fractional, whole, or pooled interests in real-world and digital assets, and is referenced inclusively as:

COLLECTIBLES

DEBT

EQUITY

REAL ESTATE

COMMODITIES

Why RarityX

Trusted Pioneer

We’ve been innovating real-world asset investment since 2006

Global Accessibility

Seamlessly move from traditional finance to crypto investment

Fractional Ownership

Unlock liquidity in traditionally illiquid markets

Secure & Enforceable

Enforceable "core" IP for Trusted RWA Markets

Professional Expertise

Designed for discerning investors who require full transparency

Scalable, RWA-agnostic infrastructure built on patented technology

RarityX is a multi-layered, institutional-grade technology and licensing platform designed to support the listing, management, governance, lifecycle tracking, and licensing of Real-World Assets, structured in accordance with applicable financial and regulatory frameworks. The platform provides configurable, enterprise-grade tools to enable fractional ownership, tokenization, and operational workflows across diverse asset categories and investment units, including tangible, intangible, digital, and hybrid assets. Importantly, RarityX’s intellectual property can be licensed to any platform, exchange, or ecosystem, enabling the integration of its technology and governance frameworks across multiple markets.

RarityX pioneered standard-setting infrastructure for Real-World Assets, delivering scalable, RWA-agnostic solutions backed by licensable patented IP—available for commercial licensing, integration, and deployment across exchanges, platforms, and the broader RWA ecosystem.

Liquidity & Settlement Layer

RarityX implements a patented liquidity and settlement layer, including—but not limited to—high-quality liquid assets, regulatory-compliant payment and stable-value structures, custody separation, digital registry and title exchange mechanisms, and primary and secondary market settlement processes.

Ledger & Data Infrastructure

A ledger and data infrastructure layer comprising distributed trading ledgers, token and RarityBit record books, raritymine and pool registries, secure multi-jurisdictional databases, provenance legacies, neutral custody nodes, cryptographic modules, and developer interfaces.

Rules Engine & Market Governance

A programmable governance and rules engine, including Rarity Operational Trading Rules, configurable pool and market agreements, automated trading engines, smart data compilers, vetting systems, market maker interfaces, and real-time rule evaluation.

Compliance & Regulatory Controls

Integrated compliance infrastructure supporting investor eligibility, jurisdictional and asset-class restrictions, KYC/AML, sanctions screening, disclosure workflows, regulatory tagging, continuous audit trails, and multi-regime reporting.

Web3 Digital Convergence

A digital convergence layer enabling immersive merchandising environments, three-dimensional asset depictions, interactive galleries, raritymine visualizations, analytical overlays, and transactional interfaces that connect on-chain ownership to rich digital experiences.

RoboRarity AI Analytics

Advanced AI analytics, including RoboRarity trading streams, RareSearcher, rarity and risk scoring engines, valuation and performance models, predictive signals, alerts, diagnostics, and institutional-grade dashboards.

Provenance & Verification

Cryptographic proofs of ownership, category-specific asset nodules, lifecycle and chain-of-custody audit chains, reserve attestations, certification records, expert registries, and forensic verification systems.

Physical Safety & Operations

Physical asset protection infrastructure, including security technologies, tagging and tracking, inspection procedures, logistics and warehousing controls, preservation standards, and operational incident handling.

Monetization & Intellectual Property

Monetization frameworks, covering platform and network licensing, institutional and developer access, transaction and verification fees, custodian participation, sovereign and enterprise licensing, and intellectual property protections.

Raritymines & Pooled Assets

Creation and management of raritymines and structured asset pools, issuance and redemption of fractional RarityBits, dynamic rebalancing, liquidity provisioning, governance rights, and interfaces that transform illiquid assets into tradable, pooled interests.

Setting Standards for Trading Real-World Assets

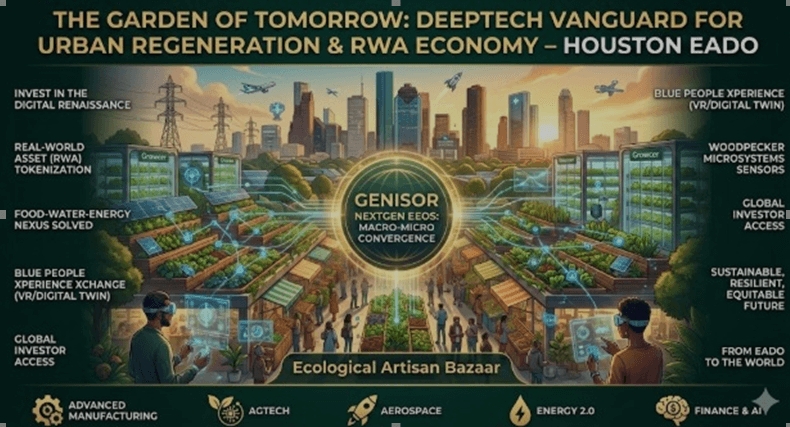

PROJECT GENISOR

A Patented NextGen AI EOS throughout the Product & Service Lifecycle that Tithes Capital with Milestone Gateways through New Universal AI Guardrails and Standards to Enhance an Organization's Odds of Success in any Community Ecosystem for Startups, Accelerators & VCs.

Patent Number: US20230237408A1 – Genisor Operational Auxilium Toolkit for Non-Fungible Assets

Fields of Interest:

- AI infrastructure & applied AI

- Cybersecurity & digital trust

- Energy transition (renewables, storage, grid, electrification)

- Sustainability technology (carbon accounting, ESG data, circular economy, waste-to-value)*

- Healthcare & the care economy

- FinTech infrastructure & digital payments (incl. tokenized finance / RWA rails)

- Robotics, automation & advanced manufacturing

- Defense tech & strategic resilience

- Climate adaptation & resilient infrastructure

- Biotech & precision medicine

- Digital media & creative content (music, books, film/TV, gaming, creator platforms)

“We recognize Liquid Rarity Exchange’s core family of patents as the indispensable engine of the emerging Real-World Asset economy, and we are strategically deploying its ‘Living Valuation’ architecture to power the financial pulse of EaDo’s Garden (…to Neighborhood…) of Tomorrow.” — Geoffrey S. Lakings, Sage Strategist, Rippling Nature | EaDo’s Garden

Let us know about your startup. Click on the button to fill out the form.

Click HereContact RarityX

Tell us who you are and what you’re exploring.

We review every inquiry personally and prioritize conversations where we can add immediate value. A member of our team will respond as soon as possible.